Industrial platforms, software platforms or independent data platforms? The key to Industry 4.0 up to the digital twin in a rapidly changing market.

This is the final part of a three-part series on Industry 4.0 and how data will play a major role in the transformation of companies in this sector.

Missed the previous episodes? Here it is: part 1 – part 2.

Vous préférez lire cet article en français ? C'est par ici.

The benefit and limitations of SCADAs

Whether it is a question of optimizing the operation of systems integrated into production and maintenance systems, or of creating new services as described in the previous part, it is becoming essential to promote data exchanges between machines and technical systems on the one hand and information systems on the other. This is the missing link between OT (Operation Technology) and IT (Information Technology) developed in the first part.

In the case of maintenance, the link must be made with CMMS (Computerized Maintenance Management System) integrated with ERP, asset management including the management of investments and their depreciation. As for the creation of new customer services, the change could be much more profound with the need to develop operational interactions, in terms of production and billing, between a supplier and a customer. In any case, there is the issue of horizontal and vertical systems integration, which is one of the key pillars of Industry 4.0.

There are three options for achieving such integration.

Option 1: integrated offerings from major industry players

The first option is to call on the industrial players in the SCADA market and more generally in the management of automation in industry. These players offer data processing platforms with business applications. We find here, in particular, the major players such as Siemens, Schneider Electric, ABB, GE, Bosch, to mention only the most emblematic in Europe.

These manufacturers have clearly understood the challenge of mastering data platforms to ensure the control of everything that happens, both in a factory and throughout the production process towards a customer.

However, SCADAs are often seen as relatively closed systems, despite the progress made in standardizing interfaces. They offer access to data. However, this data is often the result of special processing or formatting. Moreover, like the big players in the cloud for information systems, the choice of such a data management system as offered by the big players is generally a single ticket. There is so much complexity in the interlocking software components and technical systems that it is very difficult, if not impossible, to back out and consider changing providers.

Option 2: Software platforms for industry

The second option is to use software publishers specialized in industrial data processing who have developed business solutions adapted to the various industrial sectors. They know how to interface with the different types of SCADAs. The best-known solutions on the market are OSISoft, PCVue, and, to a certain extent, PTC. In addition, there are more global players such as Microsoft, IBM, Oracle, etc., which offer their own solutions.

It should be noted that OSIsoft was bought by Aveva, Schneider Electric's digital subsidiary, in 2021 for $5 billion. This demonstrates the strategic importance of this market positioning, which, by promoting a different brand from the parent company, is in direct competition with the major digital players.

Option 3: Independent data platforms

The third option consists of directly retrieving the data from all the sensors and storing it in an independent data historian. This requires the means to retrieve the raw data at the source and a high-performance technological solution to process this type of data.

SenX, with Warp 10, responds precisely to this need with a Warp 10 Edge offer. This offer can be proposed at the equipment level in order to create a local data historian, and with a centralized Warp 10 solution, which allows data to be centralized and historized over a long period.

It remains to develop the interfaces with the information system and applications that can benefit the business. This is the direction that SenX is now taking with the creation of imensi, which should meet the needs of manufacturers with solutions adapted to their business expectations.

Advantages and disadvantages of these 3 options

As it frees itself from the logic of closed systems, the third option leaves the greatest freedom of action to the manufacturer. Indeed, it emphasizes above all the importance for companies to keep and store raw data, which is their real asset, especially in industry.

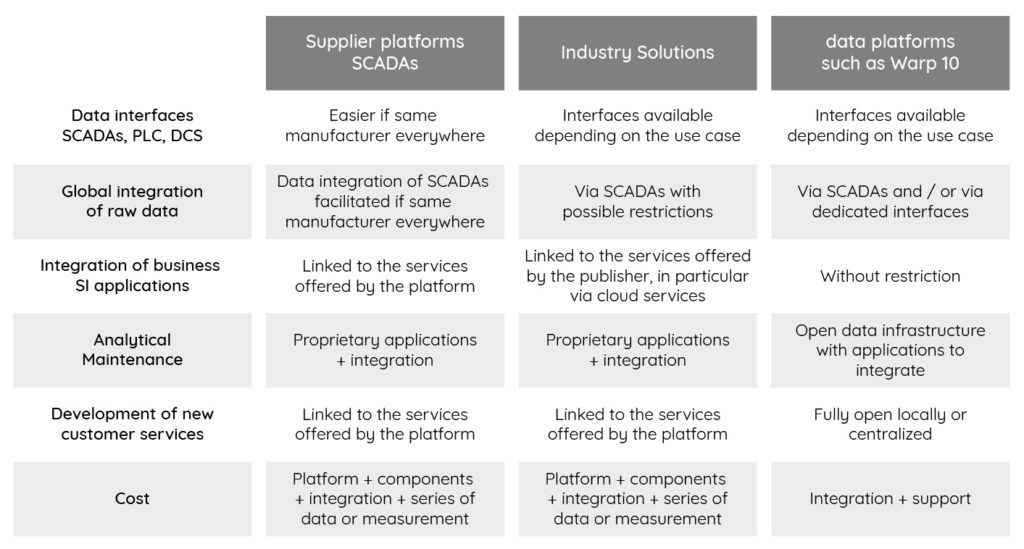

The three options can be presented in the following form. This is a naturally simplified presentation that should be adapted on a case-by-case basis to the offerings of the different market players.

Between these three options, the choice is that of positioning a cursor between :

- on the one hand, a kind of partnership with a major player in industrial IT and/or automation who takes charge of this new digital environment of Industry 4.0 with its complexity in which the industrialist does not wish to become directly involved because he considers that he does not have the skills and that it is not his job;

- on the other hand, a commitment by the company to take charge of the integration of independent solutions. Such a choice guarantees technical control while preserving the ability to develop customer services without having to depend on the commercial or even legal constraints of a third party such as the supplier of the data platform solution.

Keeping the raw data

SenX's positioning is and will remain to facilitate the exploitation of raw data history without restriction. Data is increasingly presented as a real asset for the company. In truth, if there is an intangible asset, it is the raw data.

How many cases can we find of companies that regret having, for good reasons, cleaned the data before storing it, even though the cleaning method or algorithm was not retained? One might add that the person who did the cleansing has, in most cases, left the company. Techniques evolve, people and methods change and applications multiply. What may appear to be an opportune clean-up at a given time for a particular purpose may later be seen as damaging. It is imperative to keep the raw data.

Warp 10 favors such an approach, which is the constitution of raw data historians that are independent of applications in order to better serve them as they evolve and as their uses multiply over time. And this is indeed what awaits the value chain and its evolution towards Industry 4.0.

This third option of an independent data infrastructure is not exclusive. It will in many cases combine with the other options. Quite simply because machines and systems have their own history and we must not, in constrained industrial contexts, be led to wiping out what exists. On the contrary, we must be very respectful of it, taking into account the know-how and experience of the teams on the systems they master. SCADA suppliers and industrial data platform editors will also be led to facilitate access to their data more and more. Warp 10 is fully in line with the perspective of interaction and therefore interoperability with industrial platforms. In this respect, SenX has the vocation to work in partnership with these players in this perspective.

The digital twin, the new challenge of the coming years for data processing in Industry 4.0.

All the sensors make it possible to collect data enabling the behavior of a system or a machine to be understood.

With its facilities for storing and analyzing sensor data, Warp 10 creates a digital twin for each piece of equipment. We will soon be devoting a more specific article to this subject, which goes beyond the industrial sector.

The real-time operation of a piece of equipment can then be recorded, analyzed, learned, and reproduced. All sorts of applications can then be imagined for training, maintenance, or simulation by associating visualization or virtual reality tools.

It can also be used to reiterate specific situations or to simulate the behavior of the system in as many different situations as possible.

All of the major players mentioned above, plus publishers such as Dassault Systèmes, Adobe, SAP, and many others, intend to capitalize on this new segment. According to Grand View Research, this market, although emerging, could reach more than 40 billion dollars in 2026 (and more than 100 billion in 2028 according to Emergen Research) with a growth rate of more than 40%.

A strategic market

With an annual turnover of between $400 and $700 billion depending on the scope of the market, and with the continuous growth of around 15%, the industry 4.0 market is promising. However, beyond its simple value, it is a particularly strategic issue for industries that are going to undergo a profound transformation, from their working methods to the questioning of their economic model.

Whether or not manufacturers like it, whether or not they consider this subject to be part of their business, the mastery, and control of data will have consequences for the strategy of each company in this sector. Data becomes the common thread in the questions that every company asks itself: How to facilitate the acquisition of new customers? How can I better develop recurrent turnover with my customers? How can I consolidate my position with my customers in relation to my competitors?

Each company in the industry is in fact a link in a chain in which the suppliers of some and the customers of others intend to better control the upstream supply and the downstream supply to the final customer.

| An example of this trend is the aircraft industry, where an engine manufacturer wants to retain control of all its data. But this is also the objective of the aircraft manufacturer, who wants to recover all the engine data and free himself from some of the heavy burdens of maintenance costs. The airline is also following the same logic by not wishing to be dependent on the aircraft manufacturer for the monitoring and maintenance of its fleet. Not to mention the lessors who also have similar objectives. To date, aircraft manufacturers have taken a lead over the other players in the chain in terms of data control, which is not without consequences for relations between them. |

A manufacturer who, in the future, does not control its data, risks leaving control of its products or services to another player in the value chain, whether a supplier, a customer, or a third-party supplier. This is the risk of commoditization, where all that remains is to fight on price against other competitors in the same position.

With imensi, SenX intends to participate in precisely this transformation of industrial companies:

- To SenX, the technology for local and/or centralized data processing with the ease and power of analysis of Warp 10.

- To imensi, a value offer oriented towards the implementation of Warp 10 in business tools, towards exchanges with information systems and towards services for end users.

It is this duality which, being able to be implemented in a modular way, is for us the key to mastering the data of the industrial companies that we will accompany in their transformation.

| SenX supports you in your projects to enhance your industrial data. Contact us to discuss it. |

Discover the different stages of maturity of industry 4.0 in the video below. (In French, English subtitles available)

Read more

Bite the Bytes, WarpScript bitwise operators review

Warp 10 scheduler secrets

The Raspberry Beer'o'meter

Co-Founder & former CEO of SenX